The past weekend was starting well. I had an amazing week at virtual Sibos and listened to a lot of great sessions. The cherry on the cake? I had a date night scheduled with my husband: no work, children in bed early, and most importantly wine and a movie. We decided to watch The Social dilemma.

How can I say it? My husband spoiled it all when I clicked ‘Pause’ to grab some ice-cream. He dropped this bomb:

“Hmm.. you have been talking about Open Banking1 for quite some time… Of course, I don’t know much, but conceptually, what is the difference between Open Banking and Facebook? In both cases, our data is collected and sold for the profit of a company, making us the products”.

My jaw dropped… How could he criticize Open Banking?!

After being extremely angry at my husband, I kind of understood where he was coming from. To be fair, the value chain of data and what the user exactly gives their consent to may not be 100% clear. Transparency and security have been the funding principles of Open Banking (see page 11, section 1.4.2 of this report on Customer experience principles for more details) but has it been well executed? Probably not everywhere, considering the accusations that TD bank made against Plaid2.

It’s true – it’s the user’s responsibility to check that the institution requesting data is a regulated one. But, seriously, who goes to the Financial Conduct Authority (FCA) or the Open Banking Implementation Entity (OBIE) website to check this? I bet almost no one.

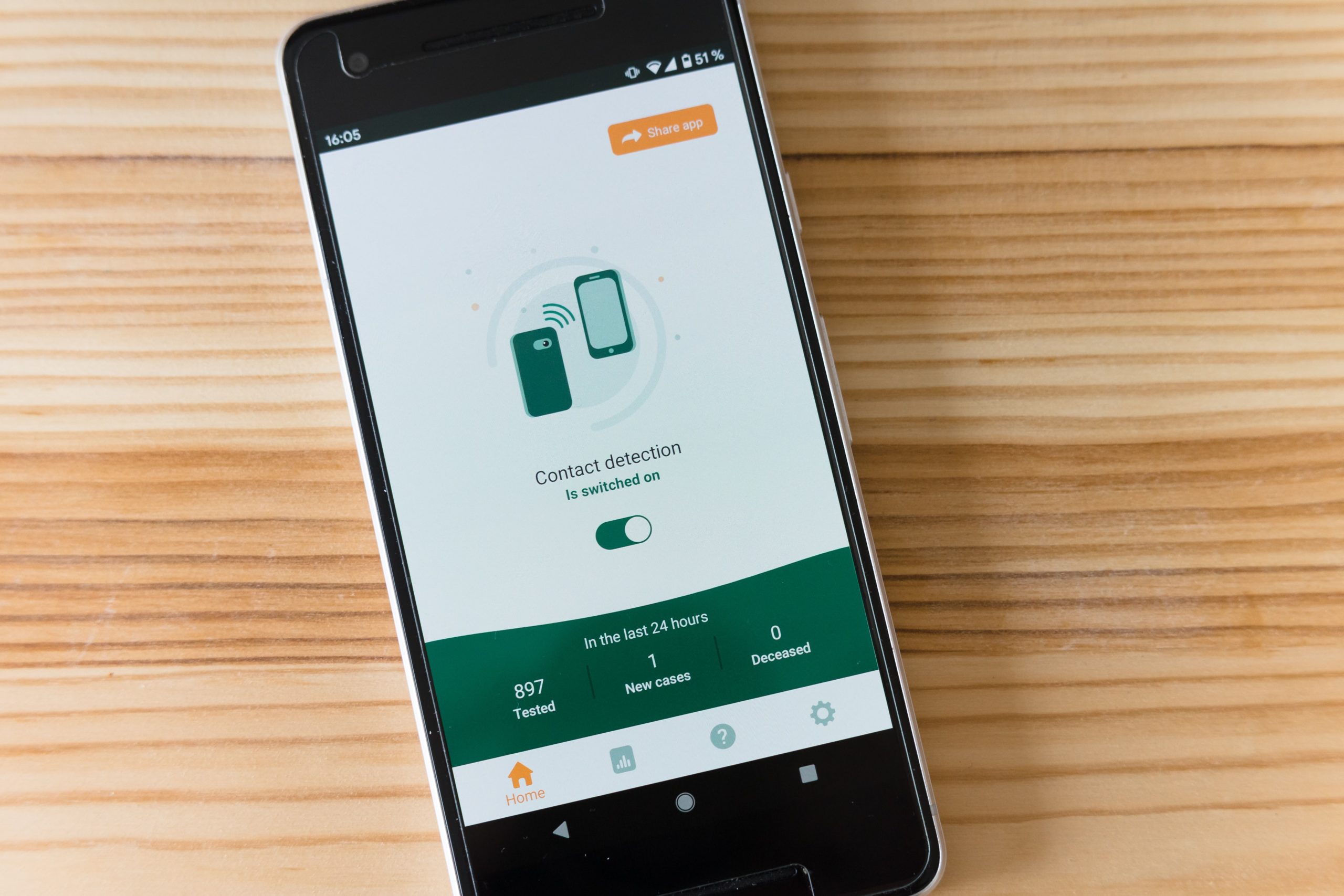

With Open Banking becoming significantly more important – they just celebrated 2 million customers – the question thrown by my husband is a serious one. Can we trust Open Banking?

Despite revealing some similarities at first sight, there are major differences between social media and Open Banking.

Our data, their access or usage are not sold by the guardians of it (the banks), or at least not in Europe. As an advertising agency, Facebook’s business model is based on this!

The essence of these two initiatives is fundamentally different. Facebook is a private initiative where revenue generation is driving decisions. On the contrary, Open Banking is a regulatory framework meant to increase competition and give customers more choice.

The banking industry is founded on trust! If a fintech wants a chance to compete against or partner with the incumbents, they must demonstrate that they are reliable when it comes to managing our data. Should it not be the case, they would go bankrupt rather quickly.

So, sorry hubby, no, Open banking is nothing like the social media, as really a lot of safeguards have been put in place. ?

By helping financial institutions to implement it, we have allowed for a better banking ecosystem, particularly in this Covid period. For this, chapeau to the RedCompass team, and looking forward to Open Finance!

1 Open Banking is a series of reforms, including ‘the second Payment Services Directive’ (PSD2), to how banks deal with your financial information. Regulated banks must let you share your financial data with authorized providers offering budgeting apps, or other banks – as long as you give your permission. How could my husband know it? That is the joy (!) of living with a payment enthusiast.

2 It is worth noting though that the case in the United States where Open Banking is less regulated.